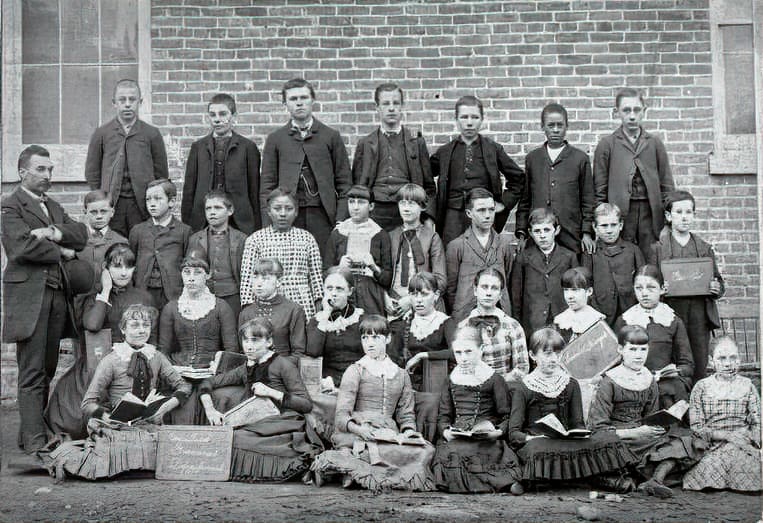

Educating children about history has been part of The History Museum’s mission since we first organized in 1867. As our photos show, styles of clothing may change over time, but teaching history to students is always important.

If history is important to you, consider a permanent legacy. Gifts to The History Museum will endow and help support us in the years to come. These may be left directly to The History Museum or to the Community Foundation of St. Joseph County by designating they are for the benefit of The History Museum.

If you do not plan for the distribution of your assets, at your death, the government can receive more than you intended. Upon the transfer of assets, the government imposes a tax – a gift tax on transfers during your life or an estate tax on gifts that pass upon your death. While it is often difficult to completely eliminate such taxes, there are ways to minimize them while helping others.

Leaving gifts to the Northern Indiana Historical Society Foundation can be a win-win situation, because planned or deferred gifts can reduce tax obligations and create a significant legacy at The History Museum. Your legacy ensures that the resources necessary to sustain our area’s history are available for the future. At the same time, you can plan for your own future with a tax-wise gift.

A provision in your will for The History Museum can be a specific dollar amount, a percentage of your estate, or a portion of your residuary estate. Such a gift is exempt from taxation and will reduce your taxable estate.

You can name The History Museum as a beneficiary of a life insurance policy or retirement plan such as an Individual Retirement Account.

Establishing charitable gift annuities provides the donor, or someone named by the donor, with a fixed income for life. For a period of years, part of that income is tax-free. The donor also enjoys an income tax charitable deduction in the year the gift annuity is funded. The person receiving the payments must be at least 60 years old when the gift annuity is created. The minimum gift amount is $10,000 cash or publicly traded securities. The charitable gift remainder trust is another type of life-income gift plan. It is usually appropriate for someone who has $250,000 or more to give in this way and can be more flexible than the charitable gift annuity. It can be funded with real property or tangible personal property in addition to cash and stocks. With the charitable remainder trust, there is more control over the payout and how long the trust is to exist.

You may want to distribute all or part of the proceeds from the sale of a house to The History Museum. Another choice is to give the residence now while retaining the right to live in it.

A charitable lead trust can provide current or future gifts to The History Museum, while eventually passing assets along to heirs. The tax savings can be substantial.

Naming a donor advised fund as a beneficiary of your IRA or retirement plan can simplify your charitable giving. Your heirs can continue to make gifts to The History Museum and other favorite charities through a donor advised fund. It is a separately identified account that is typically maintained and operated by a charitable foundation and may be available through your wealth management firm. Once you make a contribution and receive a possible current tax year income tax deduction, the charitable foundation has legal control over it. However, you, as the donor, retain limited investment direction privileges and may request distribution grants to qualified charities of your choice in the current and/or future years.

Gifts received by the Northern Indiana Historical Society Foundation are held and administered for the sole benefit of The History Museum. The endowment maintained by this Foundation provides annual funding and ensures the future of The History Museum. The Foundation is governed by Trustees and utilizes professional investment managers.

With their permission, we recognize donors in several ways, including acknowledgments on our website and social media.

We look forward to working with you to fulfill your philanthropic wishes. Please contact us if you or your advisors would like to know more about how you can leave your mark on history using any of these gifting strategies. Brian Harding, The History Museum’s Executive Director, can also accompany you to a meeting with your advisor. He may be contacted at 574.235.9664 or

808 West Washington Street

South Bend, IN 46601

574.235.9664

historymuseumSB.org

The History Museum is a 501(c)(3) not-for-profit organization